Contents

When it comes to paying workers, figuring out holiday entitlement is no easy feat. This is especially the case for those managing irregular and part-year workers. Consequently, rolling up employee's holidays into their basic pay has become a common practice amongst businesses.

But what exactly is rolled up holiday pay and is it legal?

In this article we will answer both of these questions, as well as covering the benefits, risks and calculation of rolled up holiday pay.

What is rolled up holiday pay?

All UK workers have the right to holiday pay – one week’s pay for each week of statutory leave. Whilst it is common practice for holiday pay to be paid separately to an employee's basic pay, rolled up holiday pay instead ‘rolls up’ an employee’s basic salary and holiday pay into one package.

This therefore means that the employee will receive an enhanced hourly rate, to compensate for the fact they will not receive any holiday pay during the time of their annual leave.

For employers, calculating casual and zero hour contract workers holiday entitlement can be a tricky task, as they need to consider the average number of hours worked to determine the amount of holiday pay the worker is owed. This has led to many businesses continuing to use rolled up holiday pay, despite it having been deemed unlawful.

Is rolled up holiday pay illegal in the UK?

Following Robinson-Steele v PD Retail Services case in 2006 in the European Court of Justice, the practice of rolled up holiday pay was technically unlawful in the UK. However, following the introduction of the Employment Rights (Amendment, Revocation and Transitional Provision) Regulations 2023 in January, employers can use rolled-up holiday pay as an additional method for calculating holiday pay for irregular hour and part-year workers only, for leave years beginning on or after 1 April 2024.

- Irregular hours workers - An irregular hour's worker is defined by regulations as someone who works a number of paid hours in each pay period that is, under the terms of their employment contract, wholly or mostly variable.

- Part-year workers – A part-year worker is someone who is only required to work for part of the year, under the terms of their employment contract. These workers neither work the full number of hours worked by full-time workers, nor the full number of weeks worked by part-time workers and must have a gap of at least a week in which they are not required to or paid to work.

Whilst rolled up holiday pay may now be legal in the UK for irregular hour and part-year workers, there can be some risks for businesses using this method of pay. These include:

- Potential claims against your business for unlawful deduction of wages:

If calculations are incorrect, workers may receive too little or too much holiday pay depending on the number of hours that they have worked. This could lead to a potential claim against your business for unlawful deduction of wages.

- Double payments:

Workers may argue that they have been deterred from taking holidays, entitling them to ‘just and equitable’ compensation. This means the business could end up paying the employee both their rolled-up holiday pay and compensation.

- Employee Grievance:

If an employee feels they have received incorrect holiday pay, they could bring up a grievance against the business, leading to loss of managements time.

However, having the correct payroll tools can help mitigate risk of payroll errors.

Rolled up holiday pay calculation

There are a number of ways in which rolled up holiday pay can be calculated. However, it is the rolled up holiday pay percentage calculation that is used most often.

What is the rolled up holiday pay percentage?

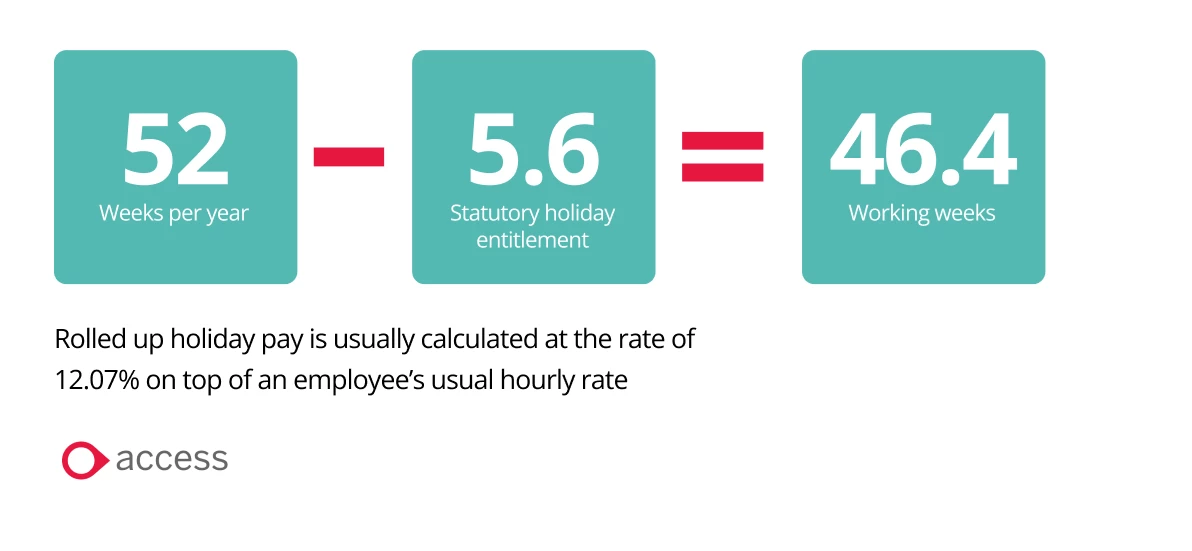

Rolled up holiday pay is usually calculated at the rate of 12.07% on top of an employee’s usual hourly rate, on the basis of statutory entitlement to a legal minimum of 5.6 weeks holiday per year. For example:

52 weeks per year minus 5.6 weeks statutory holiday entitlement = 46.4 working weeks.

So, for those receiving the national living wage of £10.42 per hour (April 2023), they would be paid an additional £1.26 as rolled up holiday pay for each hour that they have worked.

How is rolled up holiday pay calculated for employees on zero hours contracts?

When it comes to those working irregular hour & part-time contracts, the rules become complex and there are several challenges that can arise. In cases such as these, the workers' pay should be calculated on their pay over the previous 12 weeks reference period, whilst also considering any overtime, bonuses and additional payments. This method can lead to difficulties determining an accurate average hourly wage, which in turn can result in disputes over employees not receiving the correct holiday entitlement.

Alternative to rolled up holiday pay

When faced with the burdensome task of calculating flexible workers holiday leave entitlement, or factoring in annual leave when scheduling staff rotas, it’s little wonder that many employers continue to offer rolled up holiday pay.

And whilst rolled up holiday pay is no longer unlawful for irregular hour and part-year workers, there are some alternatives that offer similar benefits.

These include:

- Accrual-based holiday payment:

This is where an employee accrues holiday pay over the year, based on the number of hours in which they work. This method is calculated and paid separately to the employee's usual salary.

- Separate holiday payments:

Another alternative to rolled up holiday pay, separate holiday payments can be made in a lump sum or several reoccurring payments. This method is once again paid separately to the employees' usual salary and can be beneficial when it comes to budgeting and planning for annual leave.

Both alternatives provide the employee with more transparency surrounding their pay. However, they can be time-consuming and less convenient for the employer to process.

Next Steps

Rolled up holiday pay is a method used by business in many sectors, often with the support of payroll software, as a way to pay their employee’s holiday entitlement in one lump sum along with their regular wages. Favoured by those employing flexible workers, as of 2024 rolled up holiday is in fact legal for irregular and part-year workers.

Whilst this practice has its benefits, it continues to face criticism and can be both confusing to workers and open a business up to legal challenges such as claims against unlawful deduction of wages and double payments. Alternative methods including accrual-based and separate holiday payments provide many of the same benefits as rolled up holiday pay, whilst providing employees with transparency regarding their pay.

It is important to be mindful that rolled up holiday pay can lead to employees not receiving the correct holiday entitlements. Having an integrated HR and Payroll software can help you to manage all your employees' holiday pay and entitlement with ease, keeping you compliant at all times. To learn more about our HR and Payroll software, download our brochure.

You might be interested in:

If you enjoyed this article and found it helpful, be sure to check out our related posts: